Lead Your Network With Better Deals

Save time on deal screening and optimise your network communication with actionable data.

Built for Business Angels.

And loved by Business Angel Networks.

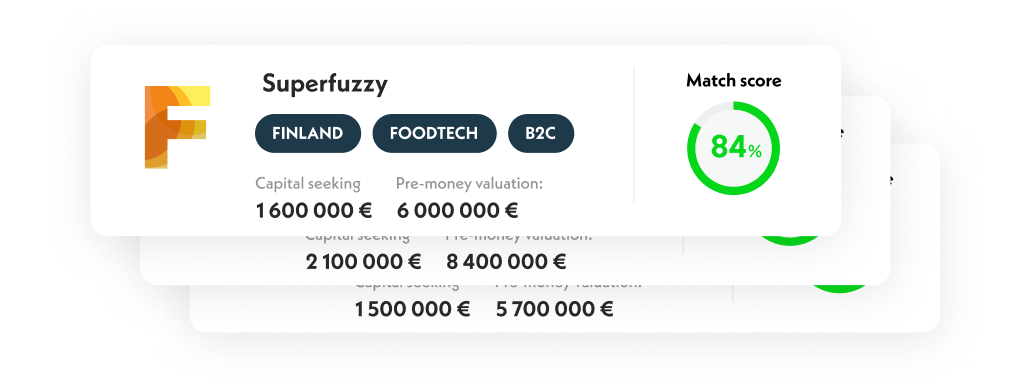

Speed up your screening

Spending your time filtering out a big volume of unqualified startups is frustrating.

Hopohopo.io compares comprehensive fundraising data of startups against the deal criteria of your network and provides your deal flow with the most relevant investment opportunities.

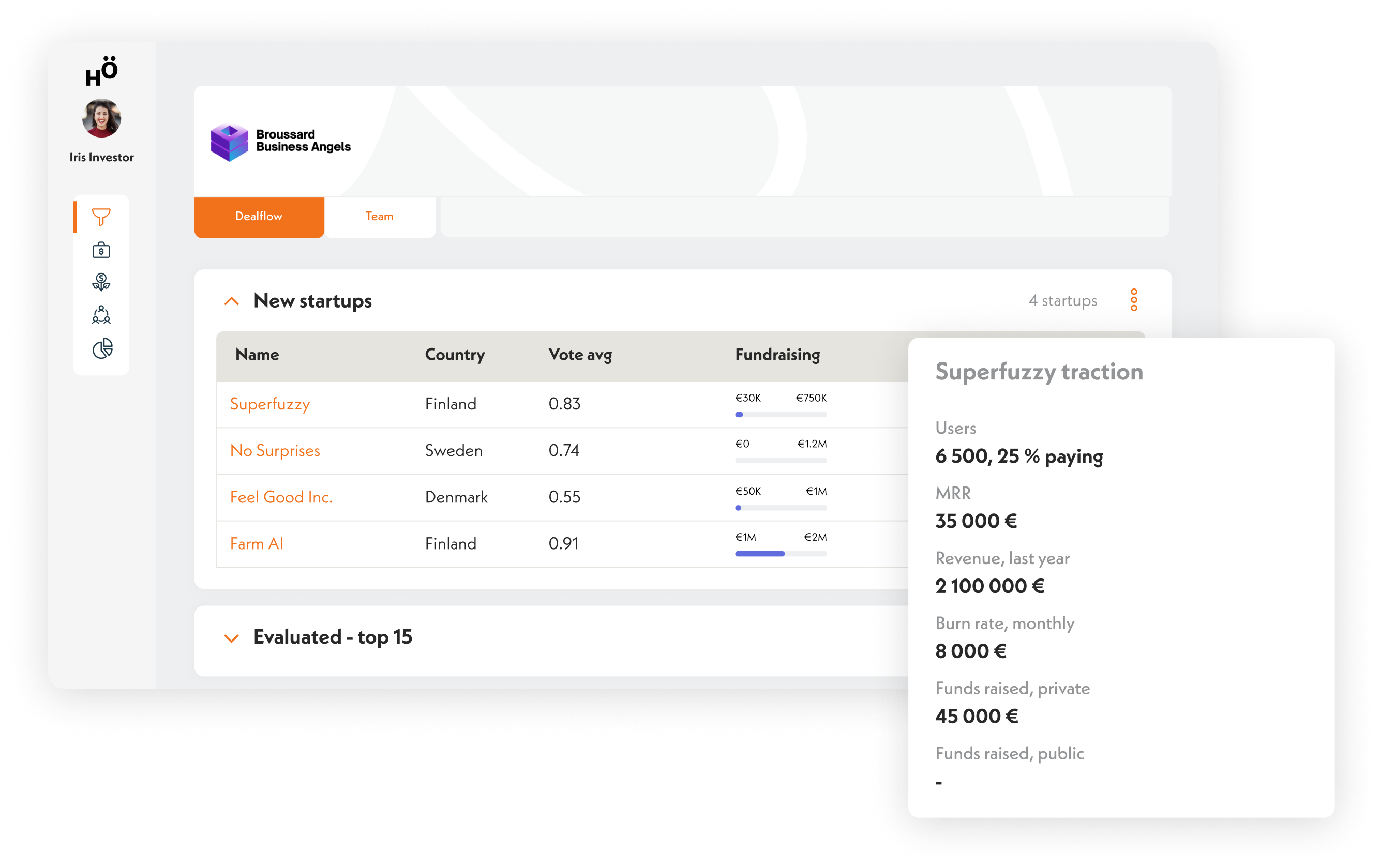

Keep everyone in sync

Only standardized data and synchronous communication can help your network stay in the loop with each other.

Hopohopo.io allows your network to collaborate on startup evaluation, send and receive referrals, and initiate open discussions between startup founders and investors.

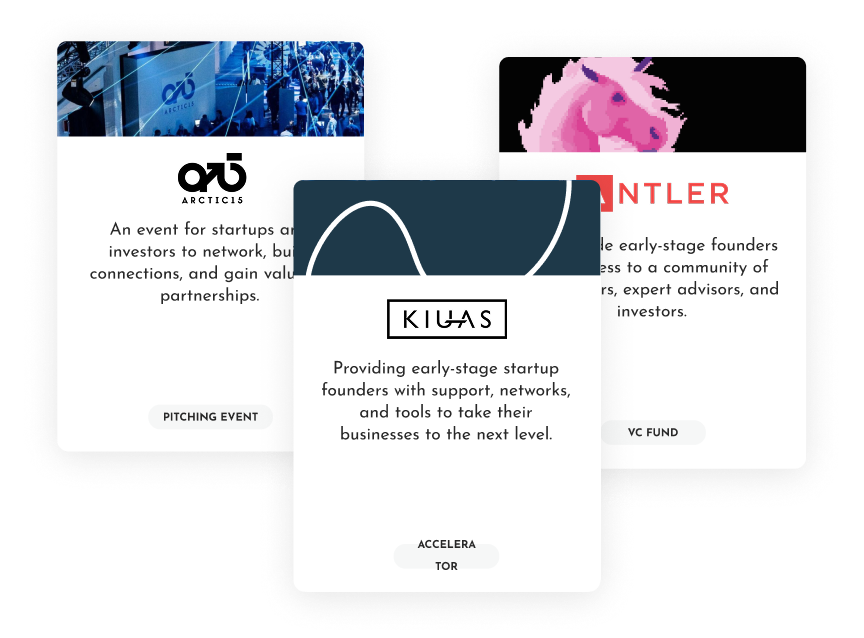

Expand your network

More action, more connections, more deals.

At Hopohopo.io, you can browse through various startup showcases sorted by the best match to your preferences. Build valuable connections with VC funds, accelerators and startup hubs, get invited to demo-days and pitching groups, and get more interesting startups to your deal flow.