Receive deals from co-investors and accelerators

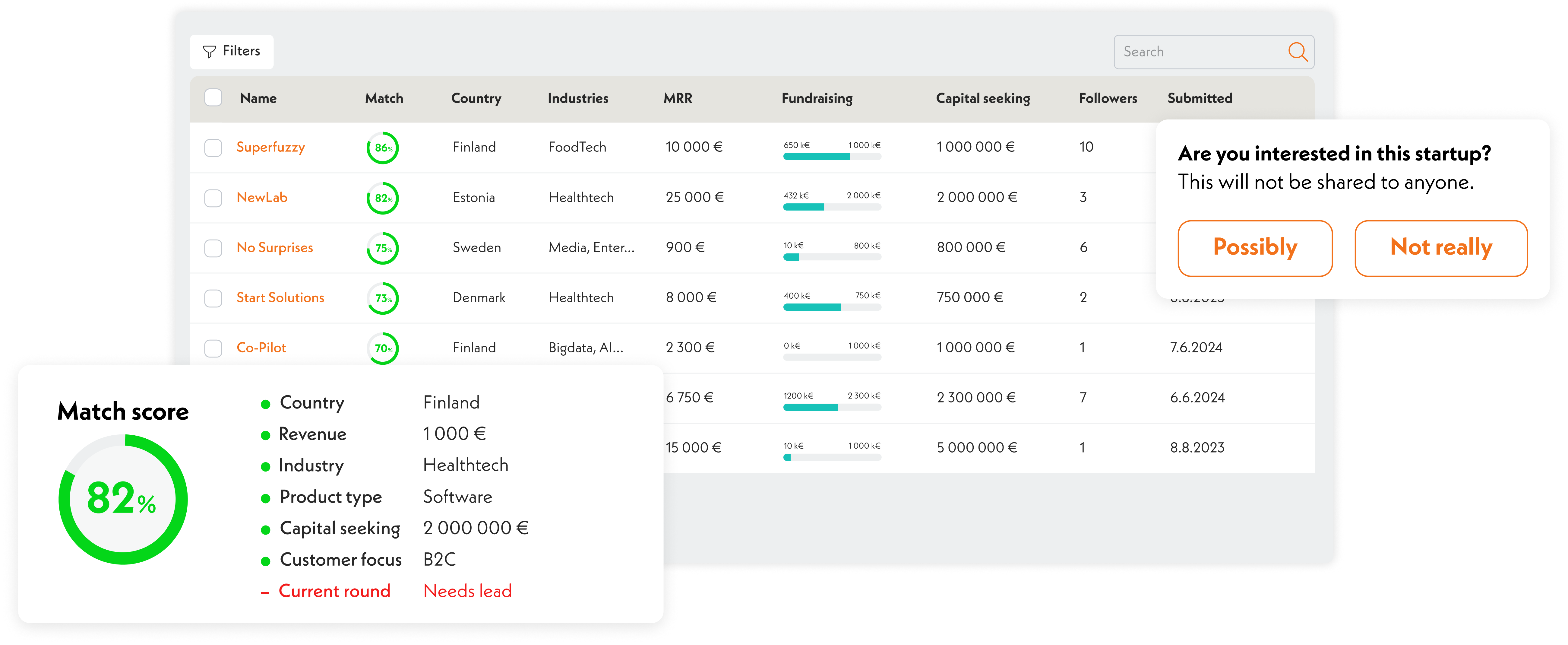

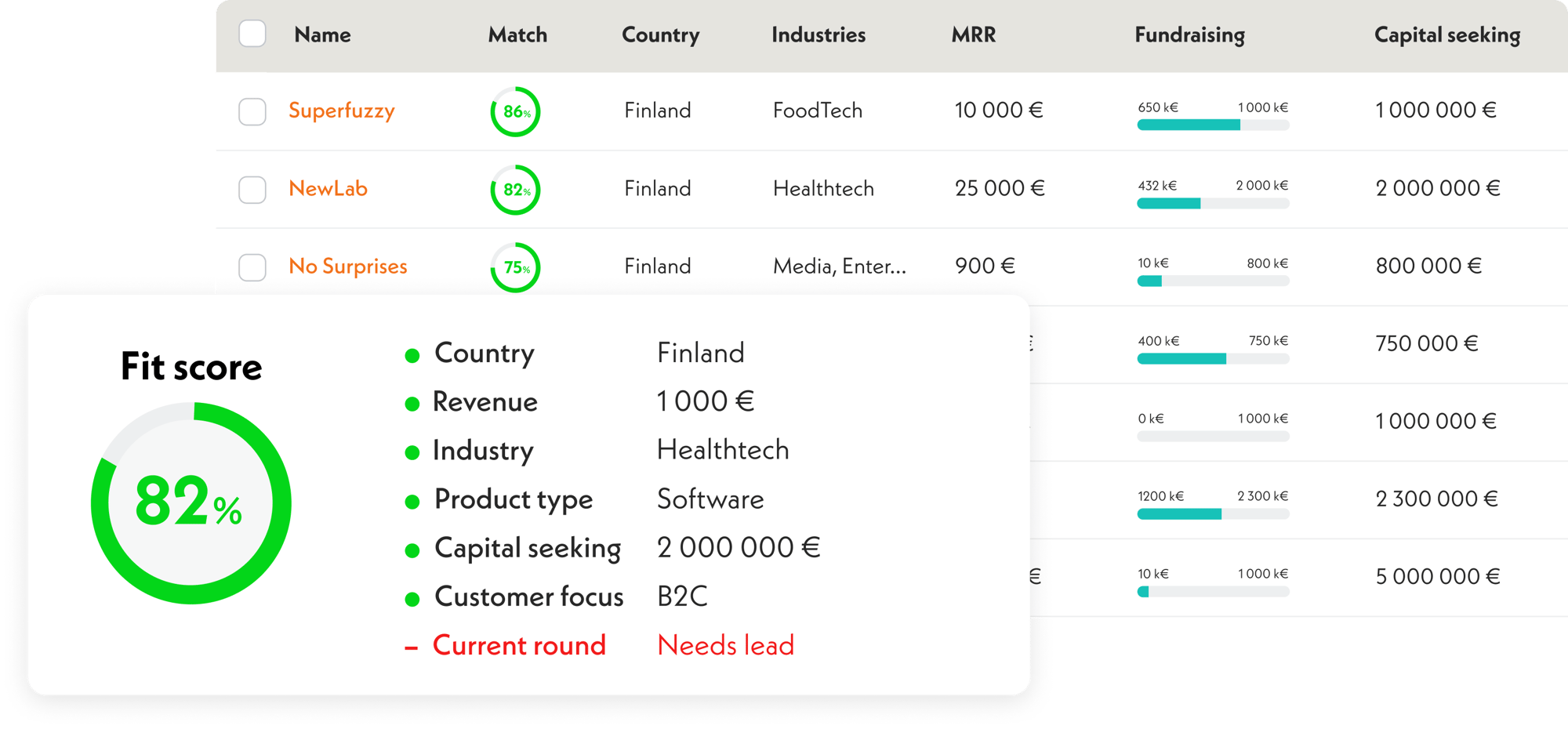

And narrow your focus to the most interesting ones.

Connect with startups backed by other investors and accelerators

Investors and accelerators use Hopohopo to help their portfolios fundraise. Publish your investment profile and get connected with matching startups from those portfolios.

How it works

1.

Publish your investment profile

Get listed in front of the startups that fit your thesis the most.

2.

Receive startup applications

Filter interesting deals and drill down with fundraising data at hand.

3.

Use our CRM or direct deals to yours

Manage your deals in Hopohopo or direct the applications to your preferred CRM.

Get started with high-quality deal flow

FAQ

Frequently Asked Questions

What startups do you have in the platform?

Most of the startups join Hopohopo as a part of portfolios of VCs, Business Angels and Accelerators. Typically they look to raise funds from Pre-Seed to Series A, and use Hopohopo to find and pre-qualify investors for outreach.

Can I screen my own deal flow in Hopohopo?

Yes! Besides receiving inbound deals in the platform, you can invite startups to apply to your dealflow by sharing an invite link, or upload a startup pitch deck to check if it's a fit.

Our AI pre-screens all the startups that land in your dealflow and highlights the fit of the main criteria, like country, industry, MRR etc.

Can I use Hopohopo with my CRM?

When you receive inbound deals in Hopohopo, you can manage them directly with our CRM.

However, you might already have a way to keep your deal flow structured. In that case, we will help you integrate Hopohopo with the CRM you use. This way, you can use Hopohopo to filter your deal flow, and still keep all the important deals where you find it the most convenient.