Active Marine Tech Investors in Europe

Updated on December 11, 2025

| Investor name | Match | Type | Country | Stage | Ticket Size | Contact methods | |

|---|---|---|---|---|---|---|---|

|

BlueForward Fund | ? | VC Fund | France | Pre-seed, Seed, Series A, Series B or later | €500,000 - €10,000,000 |

|

|

Faber | ? | VC Fund | Portugal | Pre-seed, Seed, Series A | €100,000 - €1,500,000 |

|

|

Flagship Founders | ? | VC Fund | Germany | Pre-seed, Seed, Series A | €100,000 - €1,000,000 |

|

|

Future Planet Capital | ? | VC Fund | United Kingdom | Seed, Series A, Series B or later | £250,000 - £5,000,000 |

|

|

Hatch Blue | ? | VC Fund | Ireland | Seed, Series A | €500,000 - €5,000,000 |

|

|

GO Capital - Impact Ocean Capital | ? | VC Fund | France | Seed, Series A | €1,000,000 - €3,000,000 |

|

|

Innoport | ? | VC Fund | Germany | Pre-seed, Seed, Series A | €100,000 - €1,500,000 |

|

|

Katapult VC | ? | VC Fund | Norway | Pre-seed, Seed, Series A | €150,000 - €4,000,000 |

|

|

Motion Ventures | ? | VC Fund | Singapore | Seed, Series A | US$250,000 - US$10,000,000 |

|

|

S2G Ventures | ? | VC Fund | United States | Seed, Series A, Series B or later | US$500,000 - US$5,000,000 |

|

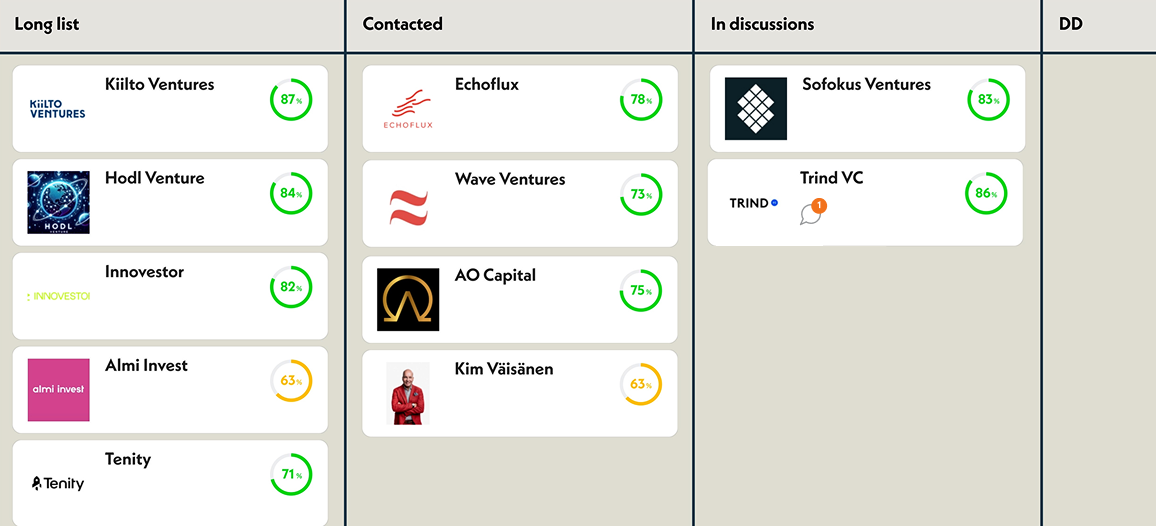

Find the best-fitting investors for your startup

Hopohopo.io algorithm goes through 50,000+ investors in the database and qualifies a list of VCs that fit your startup the most. Browse investor profiles, shortlist investors for your outreach, map warm intros, and track your funnel collaboratively with your co-founders and shareholders.